Hi ,

Isn’t it great to see the days getting longer and the weather getting warmer? Here are four stories making headlines in the early days of spring:

- Property market milestone

- FHB scheme working

- Why prices are so high

- Savings rates fall

Read more below.

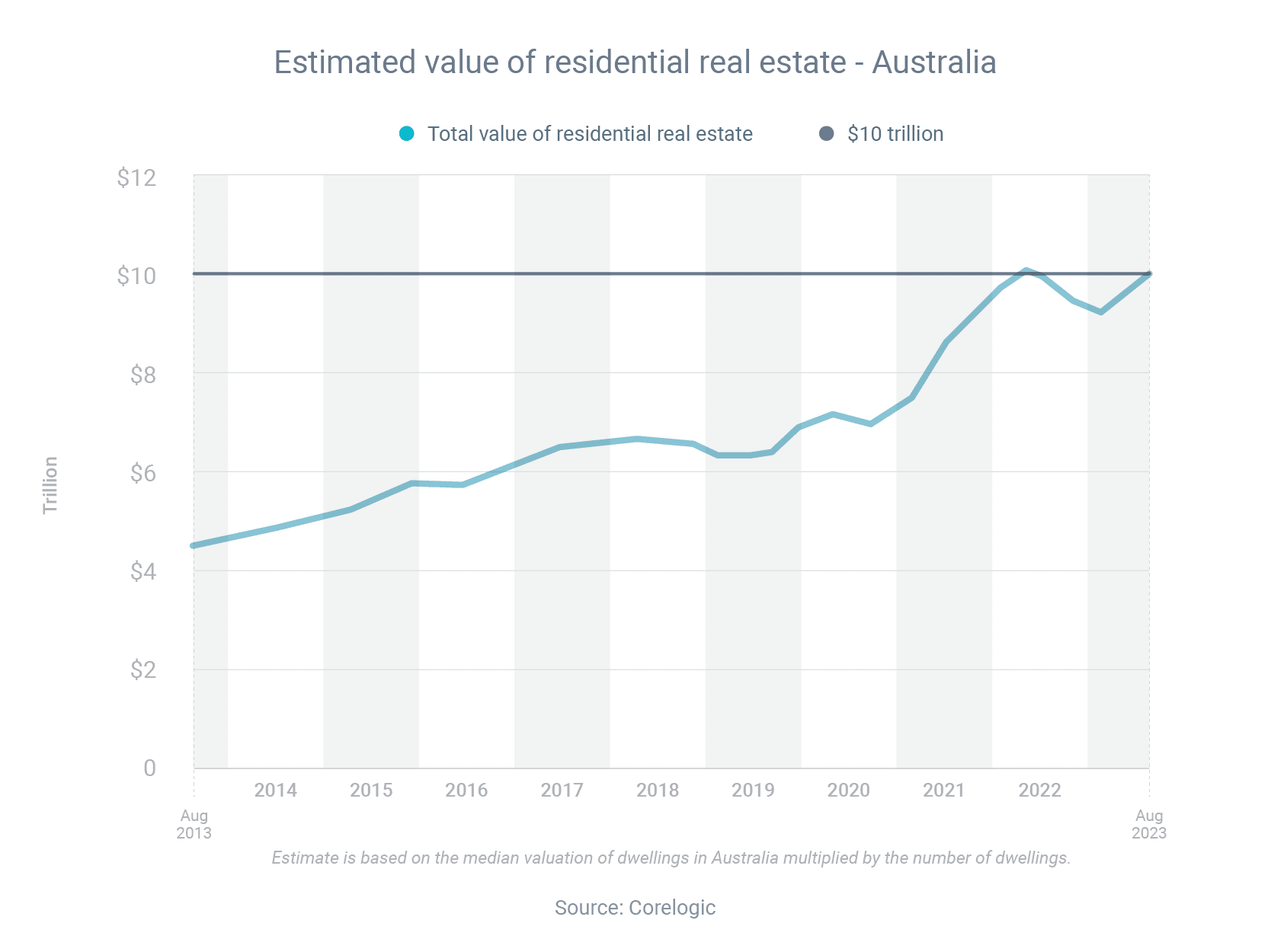

The combined value of Australian real estate reached $10 trillion at the end of August, according to CoreLogic, which is the first time it’s reached this level since June 2022.

The increase resulted from a combination of more properties being built and the value of Australia’s housing increasing.

Soon after reaching the $10 trillion mark last year, the property market began a 10-month downswing, during which the national median property price fell 9.1%. Since March, prices have risen in six consecutive months, increasing by a combined 4.9%. However, the outlook is uncertain, according to CoreLogic.

“While there is a growing expectation that the RBA board is done hiking the cash rate, borrowing remains constrained by a relatively high serviceability buffer,” CoreLogic said.

“APRA [banking regulator] data to June showed the weighted average home loan assessment rate was just below 9%, and Australian Bureau of Statistics housing lending data shows mortgage lending has fallen for three of the past four months.”

The federal government’s Home Guarantee Scheme (HGS) is helping first home buyers on modest incomes enter the market with small deposits, according to research commissioned by the National Housing Finance and Investment Corporation.

Some of the key findings from the research were:

- The average annual income of individual HGS participants was $108,000 compared with $117,000 for the broader first home buyer market

- The average deposit paid by first home buyers since 2020 increased by 3.4% (from $35,200 to $36,400) for HGS participants but 46.7% ($108,400 to $159,000) for the broader first home buyer market

- The average loan amount since 2020 increased by 4.7% compared with 13.4% for the broader first home buyer market

The research also found that the average HGS property has enjoyed an equity gain of $82,000.

Under the HGS, first home buyers can enter the market with just a 5% deposit – but conditions apply. I can tell you whether you’re eligible and help you apply for a loan.

Interest rates influence property prices, but they are not the reason that Australia has some of the highest housing values in the world, Philip Lowe said in a speech just before standing down as Reserve Bank governor.

Mr Lowe said it’s true that the lower interest rates that Australia has experienced for much of the past 30 years have contributed to the increase in property prices.

“But the reason that Australia has some of the highest housing prices in the world isn’t interest rates, which have been at roughly similar levels across most advanced economies. Rather, it is the outcome of the choices we have made as a society: choices about where we live; how we design our cities, and zone and regulate urban land; how we invest in and design transport systems; and how we tax land and housing investment,” he said.

“In each of these areas, our society and politicians have made choices that lead to high urban land and housing costs. It is by tackling these issues that we can address the high cost of housing in Australia, which I view as a serious economic and social problem.”

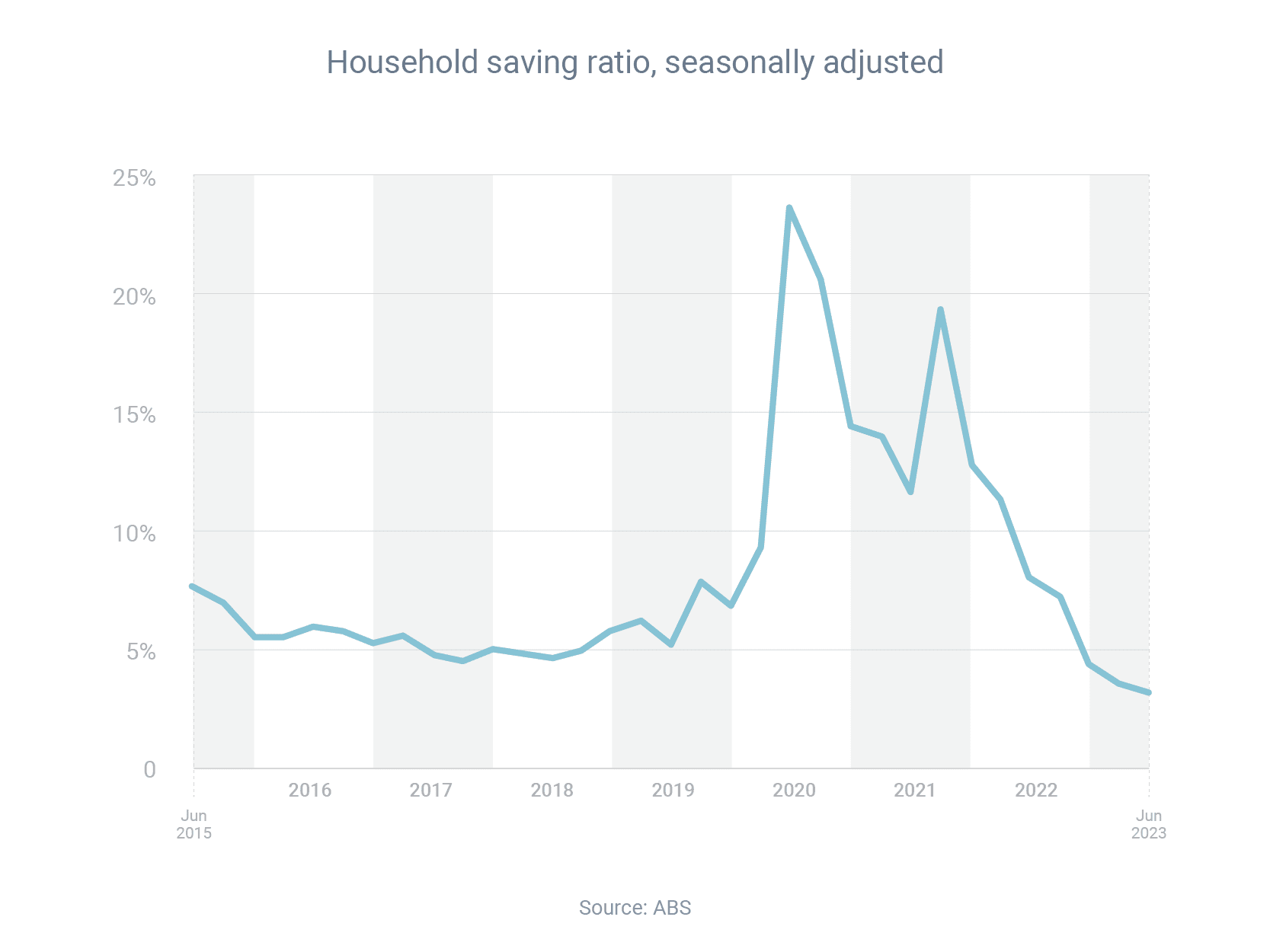

Household savings have now fallen for seven consecutive quarters, suggesting some consumers are finding it harder to save for a home deposit due to rising cost of living.

The latest Australian Bureau of Statistics data show that the share of income that households save fell significantly between the quarters of September 2021 and June 2023:

- Sep-21: 19.3%

- Dec-21: 12.9%

- Mar-22: 11.3%

- Jun-22: 8.1%

- Sep-22: 7.2%

- Dec-22: 4.4%

- Mar-23: 3.6%

- Jun-23: 3.2%

This decline in saving has been partly caused by the pandemic: people spent less during lockdown, because they were stuck at home, and then engaged in ‘revenge spending’ after being released. But it’s also been caused by the high inflation we’ve experienced during that time, which has forced consumers to spend more money just to buy the same items.

If you have a mortgage and you’re struggling to make repayments, get in touch so we can speak to your lender. Lenders tend to be more flexible with borrowers who get on the front foot about any financial problems they may be experiencing.

Thanks for reading. If you or your family need advice about home loans or refinancing, I'm here to help.

Kind Regards,Mark Mellick

(02) 9315 7749