Hi ,

There’s been an enormous amount of finance, property and tax news since my last newsletter. Here are four of the biggest stories right now:

- Fixed-rate cliff explained

- ATO warns property investors

- Regulation coming to BNPL

- Tax scam warning

Read more below.

Australia’s mortgage market is experiencing a significant shift, with many homeowners coming off two-year and three-year fixed-rate loans onto much higher variable rates today.

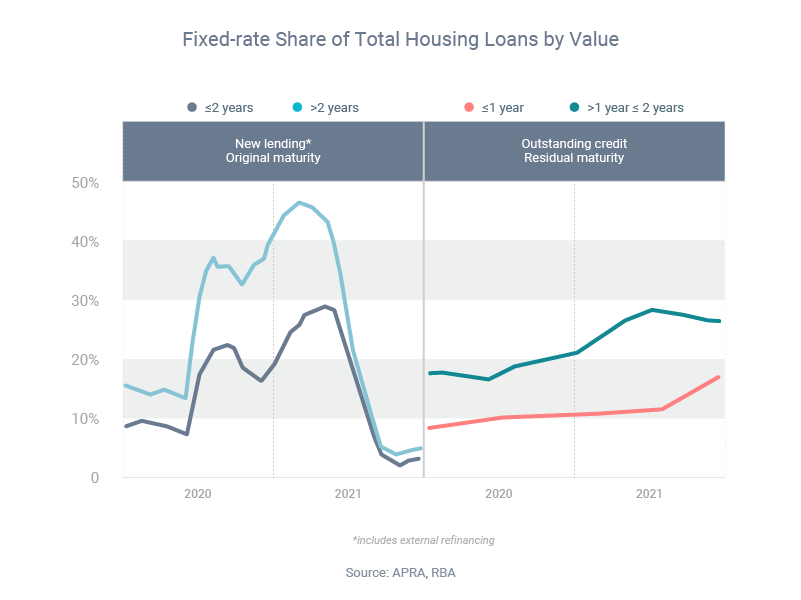

Starting during the 2020 pandemic, there was a boom in fixed-rate borrowing, as lenders slashed their fixed rates to record-low levels and many borrowers took advantage. At the peak, almost 40% of outstanding home loans in early 2022 were fixed, which was “roughly twice their usual share from prior to 2020,” according to a research paper published by the Reserve Bank of Australia (RBA).

As of March 2023, about 25% of fixed-rate loans outstanding in early 2022 had expired. By the end of 2023, another 40% will expire; and by the end of 2024, another 20%. This is what the media has been referring to as the ‘fixed-rate cliff’.

Here are three tips if you’re about to revert from a fixed to a variable loan:

- Start budgeting right now for higher interest rates

- Contact me to discuss whether you could refinance to a new lender with a more suitable fixed or variable rate

- Limit your spending to increase your chances of qualifying for a new loan

The Australian Taxation Office (ATO) has revealed it will have three key focus areas this tax time – one of which will be deductions claimed by property investors.

The reason property investors are being targeted is because an ATO review found nine in ten property investors were filing faulty tax returns. Common errors included:

- Leaving out rental income

- Making mistakes with property-related deductions – like overclaiming expenses or claiming for improvements to private properties

As a result, the ATO said it would match investor tax returns with data from home loan providers and insurance providers, to ensure investors don’t omit income or inflate deductions.

“Around 80% of taxpayers with rental income claimed a deduction for interest on their loan, and this is where we’re seeing mistakes,” ATO assistant commissioner Tim Loh said.

“For example, you can’t refinance an investment property to buy personal items, like a holiday to Europe or a Tesla, then continue to claim the interest expenses as a tax deduction.”

The ATO’s other two focus areas will be work-related expenses and capital gains tax.

The federal government will change the law so buy-now-pay-later (BNPL) products are regulated as credit products, like home loans.

The reason BNPL services are regulated differently is because, technically, they’re not a form of credit, as consumers are not charged interest.

However, as Minister for Financial Services Stephen Jones told the Responsible Lending & Borrowing Summit: “BNPL looks like credit, it acts like credit, it carries the risks of credit.”

“We have heard that some people are opening multiple BNPL accounts, to access far more debt than they’d be able to get on a credit card or a payday loan,” he said.

However, Minister Jones also said BNPL had done a lot of good for the economy, and provided a lot of benefit to both consumers and businesses.

As a result, he said the government’s legislation would be “a proportionate solution” that would allow consumers to continue enjoying BNPL while establishing “appropriate safeguards”.

The government plans to release exposure draft legislation later this year and introduce the final bill to parliament by the end of the year.

Consumers have been warned to expect heightened scam activity and new tax scams now that tax season is almost upon us.

The Australian Taxation Office (ATO) received about 20,000 scam reports in the first 11 months of the 2022-23 financial year, according to Minister for Financial Services Stephen Jones.

Minister Jones said impersonation scams – in which criminals pretend to be from the ATO – were common at this time of year.

Under these scams, fraudsters will contact people by unsolicited phone calls, emails, text messages and social media messages. They may offer to answer tax questions, promise fake tax refunds or direct users to fake myGov login pages. Often, their aim is to collect as much personal information as possible.

The ATO will never send you a link to login to their online services or ask you to send personal information via text, email or social media.

Do not respond if you receive any suspicious contact. Instead, call 1800 008 540 to check if it was the ATO speaking with you.

Thanks for reading. If you or your family need advice about home loans or refinancing, I'm here to help.

Kind Regards,Mark Mellick

(02) 9315 7749