Hi ,

Here are some interesting stories about home loans, interest rates and property investing to round out 2023:

- 23% of buyers from interstate

- RBA gives cash rate hint

- Borrowing rises 5.6%

- Credit scores rise

Read more below.

An increasing number of property investors are buying interstate, potentially because they’re chasing affordability, diversification or stronger returns.

PropTrack has reported that, over the course of this year, 23% of all buyer enquiries on realestate.com.au have come from people based in a different state. That compares to 17% in 2022, 15% in 2021 and 11% in 2020.

South Australia is the state that’s received the most interstate enquiries this year, at 29%, followed by Queensland (27%), Western Australia (25%), Victoria (23%) and New South Wales (15%).

If you’re a property investor who doesn’t want to self-manage your asset and doesn’t feel the need to drive by the home from time to time, it makes sense to at least consider buying throughout Australia rather than just locally, so you have more options.

Get in touch if you’re thinking about buying an investment property, whether locally or interstate. I’ll help you get a home loan pre-approval, so you know your budget.

Reserve Bank of Australia (RBA) governor Michele Bullock has outlined why the RBA might be forced to make another increase to the cash rate.

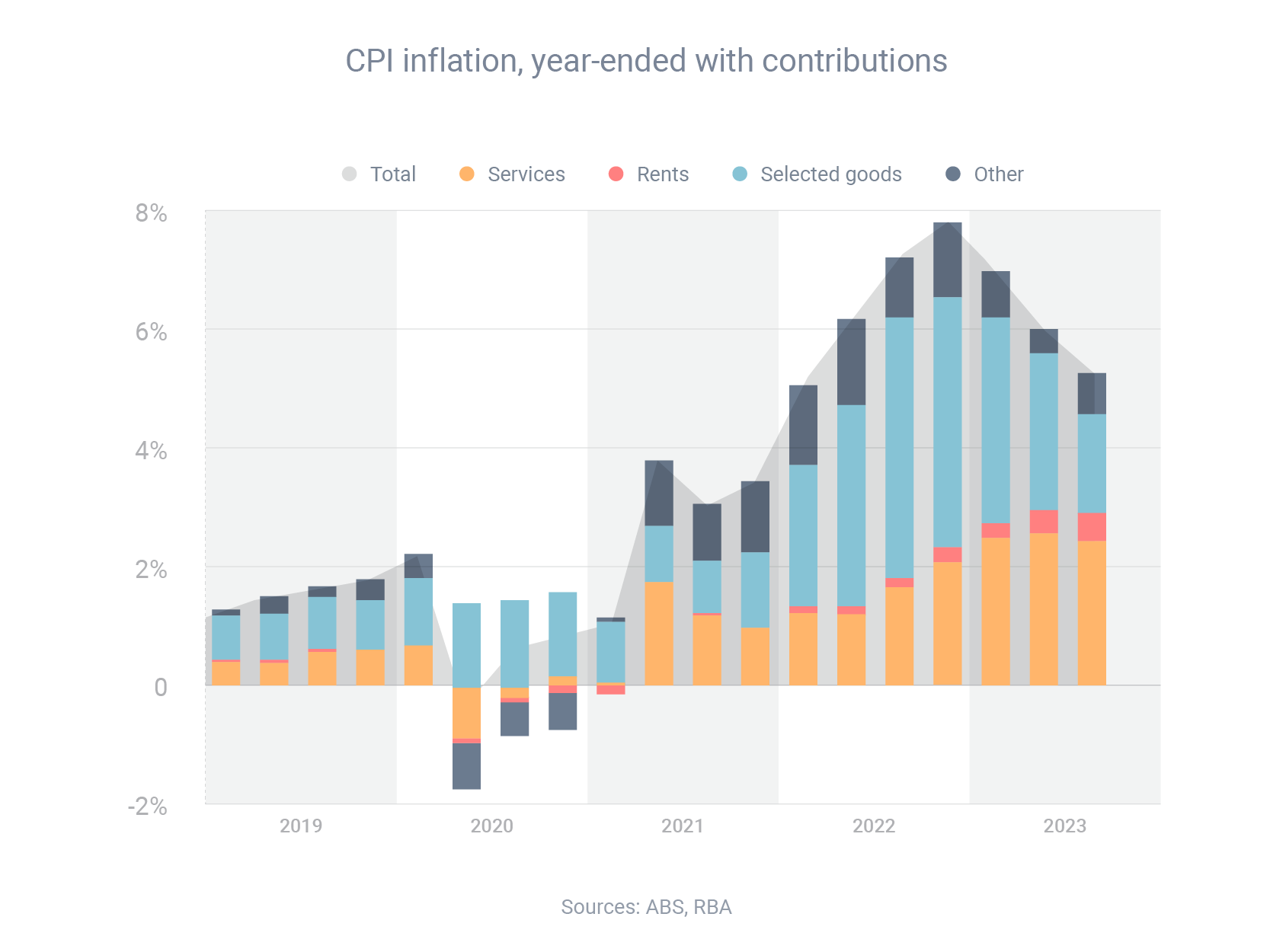

The challenge, as she explained in a speech to the Australian Business Economists, is that inflation has entered a new phase, which will make it hard for the RBA to reduce inflation from 4.9% now to its target range of 2-3%.

Governor Bullock said the initial surge of inflation, during which inflation rose from 2.1% in July 2021 to 8.4% in December 2022, was largely driven by international supply-chain disruptions. Now, though, the remaining inflation challenge “is increasingly homegrown and demand-driven”. We know that because:

- Inflation is broad-based

- Prices for services (such as hairdressers and dentists) are “rising strongly”

- Companies are struggling to keep up with customer demand

“This point is important because it has implications for the appropriate policy response,” Governor Bullock said.

If inflation was still being driven by international supply-chain disruptions, raising the cash rate would have little effect. “However, a more substantial monetary policy tightening is the right response to inflation that results from aggregate demand exceeding the economy’s potential to meet that demand,” she said.

Home loan borrowing activity is increasing among both owner-occupiers and investors.

Owner-occupiers committed to $17.23 billion of mortgages in October, according to the latest data from the Australian Bureau of Statistics. That was 5.6% higher than the month before and 1.4% higher than the year before.

Investors committed to $9.52 billion of home loans, which was up 5.0% on the previous month and 12.1% on the previous year.

Collectively, Australians signed up for $26.75 billion of mortgages, which was 5.4% more than the previous month and 4.9% more than the previous year.

Meanwhile, borrowers refinanced $17.35 billion of existing home loans with new lenders. That was high by historical standards, but was 7.0% lower than the month before and 5.0% lower than the year before, as refinancing has declined from the record levels experienced between March and July.

Despite rising interest rates, Australians have improved their credit score over the past year.

The national average credit score rose from 846 in 2022 to 855 in 2023, according to an analysis of more than two million credit scores by credit bureau Equifax.

That means the average Australian has improved from ‘very good’ to ‘excellent’, based on Equifax’s gradings:

- Excellent = 853 to 1200

- Very good = 735 to 852

- Good = 661 to 734

- Average = 460 to 660

- Below Average = 0 to 459

Lenders generally check your credit score when you apply for a loan – and the higher your score, the more likely your application will be approved and you’ll get a lower interest rate.

To build and protect your credit score, Equifax recommends:

- Establishing a rainy-day fund

- Paying bills, loans, credit cards and rent on time

- Checking your score regularly (you can order a free copy of your credit report every three months)

- Closing unnecessary credit accounts

- Limiting the number of credit applications you make

- Contacting your lender if you’re worried about falling behind on payments

Thanks for reading. If you or your family need advice about home loans or refinancing, I'm here to help.

Kind Regards,Mark Mellick

(02) 9315 7749